1. Background

|

|

Company A signed 8 loan contracts with Bank B in 1997. The total principal is RMB 43.03 million, including principal of RMB 17.13 million which is secured by the machinery and equipments of Company A, and principal of RMB 18.33m which was guaranteed by Company C, the supervised company of the borrower. Company A failed to repay the principal when the loan contracts fell due. The outstanding balance has reached RMB 49.65 million at the end of 2003. |

|

|

In Jun.2000, Bank B transferred those creditor’s rights to Asset Management Company D, and in 2005, the creditor’s rights was transferred to the current owner. FYT was officially engaged to manage the portfolio in 2005. |

2. Challenge

|

|

The borrower is a state-owned enterprise and the business had been stopped in 1999. The total debt owing to outside parties was over RMB 100 million. The relocation of the employees was a heavy burden on the borrower. |

|

|

The mortgaged machinery and equipments of Company A had almost not existed. No other asset was found. |

|

|

Since the former creditor had not continually claimed its right to the guarantor during the guarantee period. The guarantor had been exempted from the liability. |

3. Strategy

|

|

Fan Ya Tai has sorted out 8 loan contracts and the related documents from the archive of Company A provided by Asset Management Company D, and found that principal of RMB 10.03 million may be secured with collateral. However, the documents on hand could not completely support this. |

|

|

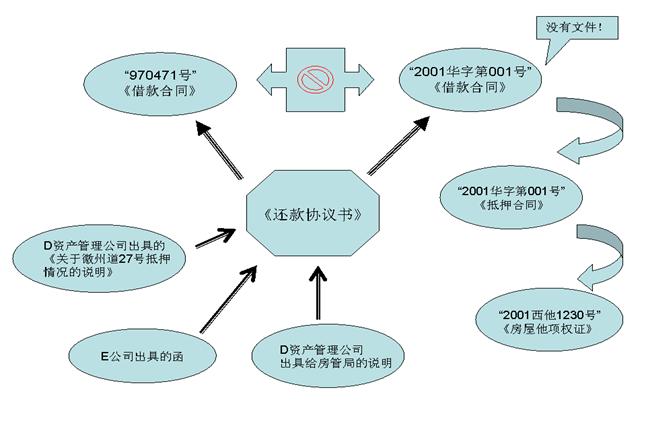

In the 8 loan contracts signing between Company A and Bank B, there is a loan contract coded: “97047号” with principal of RMB 10.03 million. The contract term was from July 1997 to July 1998. |

|

|

There is a Mortgaged Contract coded: “2001华字第001号” signed between Company A and Asset Management Company D in the archive, which was used to secure the principal of RMB 10.03 million. The related secured loan contract was coded “2001华字第001号”. The collateral was Company E’s house property which located in No. 27, Huizhou Dao, XX District. |

|

|

There is a House Property Lien Certificate coded “2001西他1230号” in the archive of Company E, where showed its attached mortgaged contract is coded “2001年华字第001号”. The record in the local House Administration Bureau showed that the mortgaged house property has been sealed by another court. |

|

|

From Company E’s documents, Fan Ya Tai found out that Company E had issued a letter to Asset Management Company D before, and stated that it was willing to use the house property in No. 27, Huizhou Dao as collateral to guarantee the Company A’s loan contract. |

|

|

From Company E’s documents, Fan Ya Tai found a statement issued by Asset Management Company D to local House Administration Bureau to process the lien certificate. It was showed in the statement that Company E’s land and house property in No. 27, Huizhou Dao, XX District was the collateral to secure the loan contract signed by Company A. |

|

|

However, there was neither loan contract coded: “2001华字第001号” and related receipts in the archived documents, nor any document to prove that loan contract “2001华字第001号” and loan contract “970471号” were the same loan (although the principal in these two loan contracts were the same). With only the collateral lien certificate, the owner was unable to priority claim for the collateral without the key loan document. |

|

|

Fan Ya Tai analyzed that the loan contract coded “2001华字第001号” actually may not come into effect because Asset Management Company D was not allowed to engage in lending business. Meanwhile, there was no document to show the owner obtained the creditor’s right of Loan Contract coded “2001华字第001号” from Asset Management Company D. Therefore, whether the loan contract “2001华字第001号” could be found out, it would not be critical for the owner to claim for the collateral right. |

|

|

After Fan Ya Tai’s thorough investigation, a key evidence was found. Fan Ya Tai found out that Asset Management Company C and the borrower, Company A, signed a Repayment Agreement on September 4, 2000. It was stated in the agreement that the borrower’s supervised company use the land and house property in No. 27, Huizhou Dao, XX District as the collaterals to guarantee for repayment of the Loan Contract “97047号” with principal of RMB 10.03 million and interest. |

|

|

The collateral was offered by a third party, but the third party did not sign Loan Repayment Agreement. Even Company E had issued letter to Asset Management Company D to provide the guaranty for Company A’s loan, it did not clearly state the guaranty object in the letter. Company E may only accept the Loan Contract coded:“2001华字第001号”, but deny the Loan Repayment Agreement. To confirm this, Fan Ya Tai collected evidence in the local House Administration Bureau. At the meantime, Fan Ya Tai requested Asset Management Company D to issue a written Explanation on the Mortgage Status of No. 27, Huizhou Dao. In the statement, Asset Management Company D explained clearly the formation of RMB 10.03 million creditor’s right and the transfer and mortgage status of the loan. These documents have formed a completed evidence chain. |

|

|

Fan Ya Tai suggested the owner to sue Company A, and the owner won the lawsuit. The court has confirmed owner’s right on the mortgage property. |

4. Achievement

|

|

Fan Ya Tai arranged to transfer the loans after wining the case and recovered RMB 10.03 million for the client. |

|

|

The recovery rate of this credit right is 23.3% of the principal, or 10.82% of total legal balance. |

|